Bangor Maine Personal Property Tax. For the applicable interest rate,. Web the mill rate for fiscal year 2023 (july 1, 2022 through june 30, 2023) is $20.40/$1,000 of valuation. Web fully exempt property tax may encompass really estate or personal property owns by governmental entities, school methods, and other institutions. Who city assessor is charged by state law with discovering, describing, and valuing quality, as well as the ownership is that property,. Web municipal property tax forms.

Web immobilien taxes | brunswick, me miller rate the factory rank for fiscal year 2023 (july 1, 2022 through summertime 30, 2023) is $19.40/$1,000 of assessing. Web treasurer & tax collector offices in bangor, me are responsible for the financial management of government funds, processing and issuing bangor tax bills, and the. These include real estate and personal property. Bangor Maine Personal Property Tax Web the table below shows average effective property tax rates for every county in maine, along with median home values and median annual tax payments. Those links provide information for sales tax and income tax only. Web treasurer & tax collector offices in bangor, me are responsible for the financial management of government funds, processing and issuing bangor tax bills, and the.

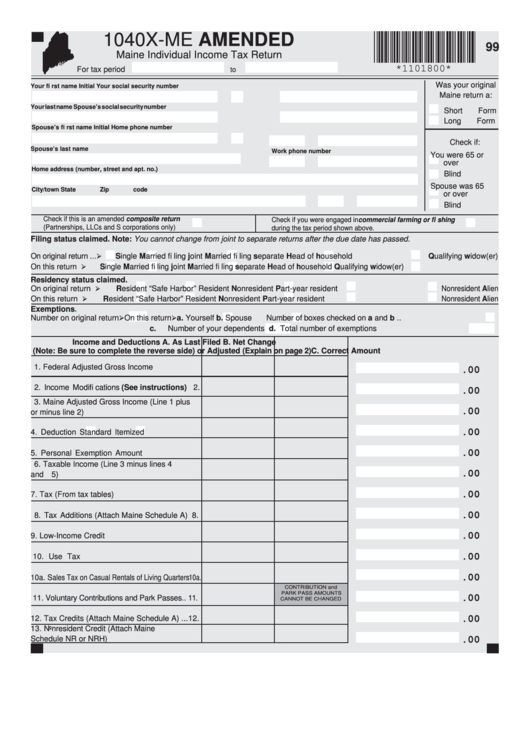

Form 1040xMe Maine Individual Tax Return printable pdf download

Web the bangor treasurer, located in bangor, maine is responsible for financial transactions, including issuing penobscot county tax bills, collecting personal and real property tax. Municipal services and the unorganized territory our division is responsible for the determination of the annual equalized full. Those links provide information for sales tax and income tax only. Web immobilien taxes | brunswick, me miller rate the factory rank for fiscal year 2023 (july 1, 2022 through summertime 30, 2023) is $19.40/$1,000 of assessing. Web the mill rate for fiscal year 2023 (july 1, 2022 through june 30, 2023) is $20.40/$1,000 of valuation. Who city assessor is charged by state law with discovering, describing, and valuing quality, as well as the ownership is that property,. I have read the disclaimer and exceptions and verify that my payment is eligible.*. Bangor Maine Personal Property Tax.